Fuelling up your car may seem like a mundane task, but did you know that petrol stations are hotspots for crime? From ATM bombings to armed robberies, petrol stations face a range of risks that can leave customers and staff vulnerable. Unfortunately, Gauteng has been hit the hardest by these crimes. In this blog, we'll dive into the top crime risks faced by petrol stations and how Dealers can minimise the impact of these.

Petrol stations, like any other business, are exposed to several crime risks. Some of the top recorded crimes at petrol stations are burglary, ATM crimes (e.g. bombing), robbery/armed robbery, vehicle theft, hijacking of staff or customers, retail shrinkage (shoplifting and employee theft), assault (of petrol attendants and customers), petrol card fraud, vandalism to the security measures or malicious damage to the property, and cash heists. Gauteng reports the highest statistics of the crimes above.

In their annual report, the South African Petroleum Industry Association (SAPIA) reported that in the early 2000s, various oil companies in South Africa decided to combat crime at petrol stations as a collective. These oil companies formed a forum called the Oil Industry Security Forum (OISF). This forum was formed with the view of looking into security measures at petrol stations and to advise the oil companies regarding any improvements needed for better and improved security at petrol stations. This committee had to ensure that petrol stations work hand-in-hand with the South African Police Services, Metro Police and armed response security companies.

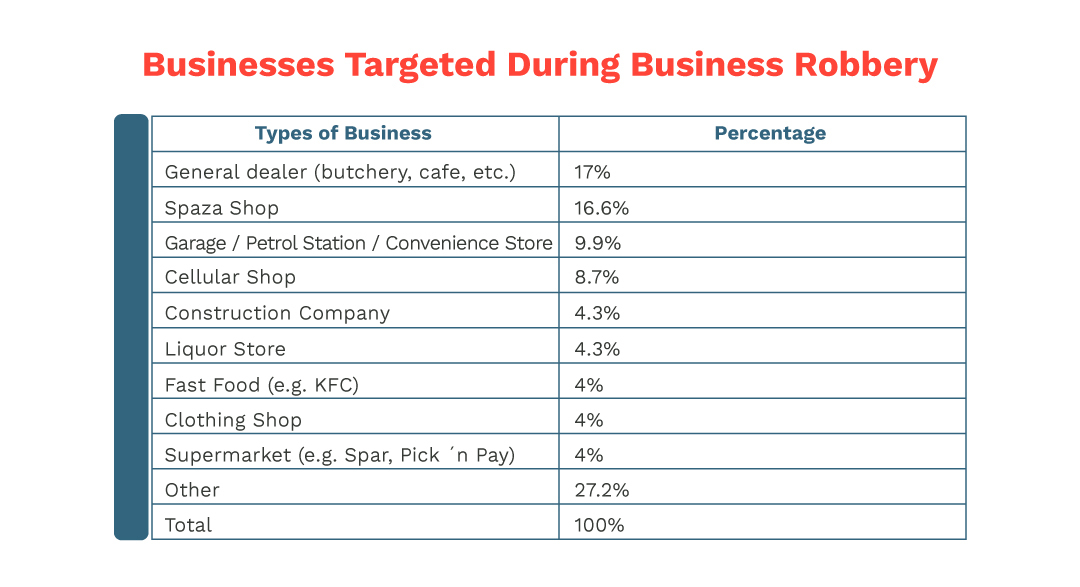

From the table above, it is clear that petrol stations are vulnerable to criminal risks. According to the SAPS Annual Report, 2008/2009 most of the robberies took place during the time the business was closing or opening. It would normally be between 18:00 – 20:59 (22.5%) and between times 09:00 – 12:00 (16.2%). In 2009, SAPIA reported that crimes that were on the increase were cash-in-transit and hijackings. Incidents relating to robberies at petrol stations decreased from 782 in 2008 to 611 in 2009. Unfortunately, the numbers have continued to rise in various parts of the country. With the petrol prices increasing consistently as well, some customers have resorted to crime by driving off without paying.

Police are not effectively combating crime at petrol stations due to a myriad of reasons. For petrol station crimes in particular, their challenge is a lack of expertise in handling organised crime. In some instances, police do make an arrest but most of these cases are not successfully prosecuted in court because by the time the police had effected an arrest, they had not followed basic policing/conventional methods from the beginning. Allied with this, is the fact that SAPS detectives carry a high volume of cases.

Crime has serious negative impacts on petrol stations. Some Dealers resort to selling their petrol stations because they do not make the level of profit, they expected because of crime losses. Others have to close at night (high-risk time) giving rise to reduced numbers of petrol attendants working at night with those without night work at petrol stations becoming unemployed. This also results in customers not being able to access petrol stations close to them because they are closed.

Losses will always be with us. As Dealers, we must control these losses and minimise them through loss prevention programmes. Businesses will always be faced with risk challenges from crime or financial loss. It is for that reason that business owners will need to have insurance to cover their businesses.

Getting insurance cover in business usually covers various categories of loss. The following categories may be taken as cover:

This covers all crime-related losses. It is a known fact that this cover would be ideal for petrol stations given the almost daily criminal attacks on them.

While this would have seemed like something that happens in movies, there is a growing trend in SA. This covers incidents where any member of staff is kidnapped, and a ransom needs to be paid. This, in most cases, applies to a Dealer where they and/or their family members would be kidnapped, and they would be expected to pay a ransom.

This refers to intentional or unintentional acts/omission or commission of an act leading to injury and/or loss (damage). An owner would need such cover for such unpredictable or unknown situations as floods or fire.

Business interruption insurance is insurance coverage that replaces business income lost in a disaster.

PetroCONNECT Employee Empowerment and Skills Development services can assist in identifying skills shortages for your employees.

The Labour Relations services can ensure that the working conditions of your employees protect you and your employees.