Petroleum and diesel are a part of daily life, but have you ever wondered how crude oil becomes the fuel that propels your car? And what can go wrong in that process? If so, here’s our crash course on the petroleum value chain, along with the challenges South Africa is facing within it.

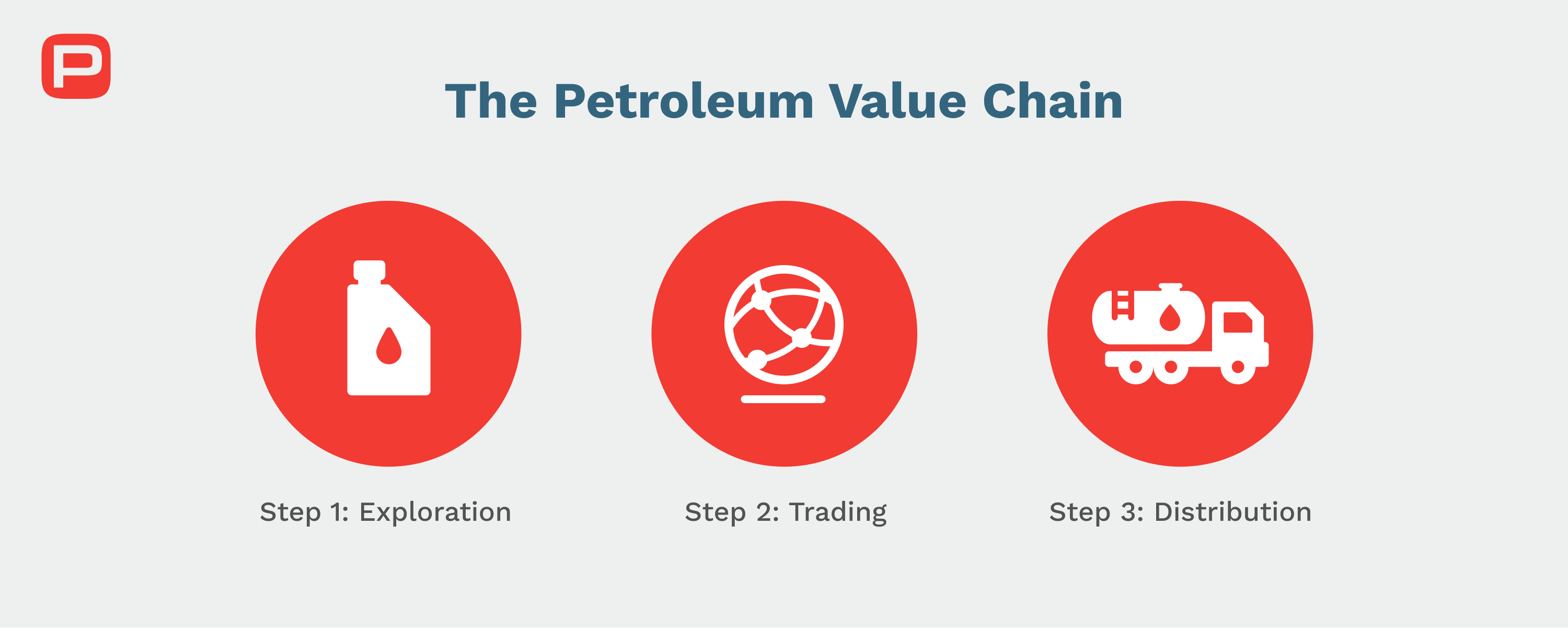

There are three fundamental steps involved in the petroleum value chain: exploration, trading, and distribution. Read on to discover what is involved in each step.

The very first part of the journey is to find crude oil. This process is called “upstream” while the refining process is called “downstream”. Exploration involves finding and researching the best opportunities for crude oil drilling, also known as geological mapping and prospecting. When done well, exploration minimises risk.

Once the crude oil has been found and extracted, the next step can take place. Trading involves refining the crude oil into fuel products, which is then transported by pipeline, rail, or tankers in the distribution phase. Trading also requires storage and the wholesale marketing of crude oil.

The next step in the petroleum value chain after trading has been implemented is distribution. This downstream process involves the transportation and marketing of end-user products like petrol, diesel, and propane gas. These products are moved from refineries by pipeline, rail, sea and road to approximately 200 depots, over 5000 service stations across SA, according to SAPIA.

According to data platform Knoema, South Africa consumed 497 000 barrels of refined petroleum products per day in 2021. That translates to 79 million litres of fuel a day.

The Government regulates wholesale profit margins and controls the retail price of petrol. The Department of Mineral Resources and Energy calculates the price using the BFP (Basic Fuel Price) formula which was instituted in 2003.

In each of the steps of the petroleum value chain, South Africa faces hurdles. Can the country clear the hurdles to the benefit of both the consumer and fuel retailers?

Refining

As South Africa has limited oil reserves, 95% of our crude oil requirements are met by imports. According to Rod Crompton, professor at the Wits African Energy Leadership Centre, three of South Africa’s oil refineries have closed in the 2020 and 2021. Crompton says that the last remaining oil refinery, owned by NAtref, temporarily closed in 2022 due to delays in crude oil supply impacted by Russia’s invasion of Ukraine in 2022.

In March 2022, both BP and Shell announced a temporary halt of operations in Durban, and Engen made a similar decision. This threatens the country’s energy reserves, though leaders are committed to keeping South Africa afloat. The answer may lie in developing a ‘mega refinery’ as other developed countries have been doing, says BusinessTech, rather than relying on smaller refineries to stay afloat and upgrade their sites.

Wholesaling

Until recently, there was a limited number of non-refining wholesalers who supplied petrol and diesel throughout South Africa. The number of wholesalers registered with the Department of Energy has soared, the majority of which are based in Gauteng.

While the broad range of wholesalers may be a positive for decentralising the market, it can be a challenge for fuel retailers to choose who to trust. That’s where we come in.

While the number of wholesale licenses have soared in recent years, it must be noted that a large number of these lie dormant. This is largely because many retailers are locked in supply agreements with oil majors which prohibit open market supply. New wholesalers find it extremely difficult to break into this closed market. Other prospective buyers are farmers, mines and construction companies. It’s a highly competitive space, low margin and large volume business.

The PetroCONNECT network

We have developed a sellers, owners, and dealer network to put the right people in touch with each other. We put a special focus on the valuation of your site, matching the right buyer with the right site, pre-qualification of a buyer, guided assistance of the buyer to streamline the entire sales process, fast-tracking the parts of the process that PetroCONNECT can control.

The PetroCONNECT sales process facilitates every step:

If you’re in the market to buy or sell, find out more about sale of sites.

PetroCONNECT can help you navigate new site development opportunities and licensing requirements for a service station. Three sets of approvals are required before a new service station can be developed:

PetroCONNECT provides end-to-end solutions for Site and Retail Licenses in line with the DMRE according to the requirements of the Petroleum Products Act (PPA), to deliver license approvals within acceptable time periods.